Life insurance

can mean different things for different people; there are as many reasons for purchasing coverage as there are policy and coverage types. If you are trying to determine whether you or a loved one needs life insurance, the simplest approach is to determine whether someone else could struggle financially when you die. If the answer is "yes", you probably need life insurance.

Life insurance death benefits provide cash benefit payments to your named policy beneficiaries, who generally

receive those benefits income-tax free

and can use the proceeds to help lessen the financial strain your death can bring.

The following examples illustrate why people in various situations should consider purchasing the financial protection life insurance offers:

Single Individuals

Single people often buy life insurance

to ensure their loved ones will have money available to pay for final expenses, including costs of a funeral or memorial service, cremation and/or burial. Life insurance can also provide needed funds to pay off your debts, so your loved ones aren’t saddled with them.

If you are single but

others depend on you financially

for support, such as a committed partner, a parent or a sibling, life insurance can help by providing income replacement that can take the place of your support when you die.

Buying life insurance

as a young, single person is also a smart move because the cost of coverage is based in large part on your attained age when you apply for coverage. By buying a policy when you’re young, you can lock in your insurability and obtain affordable coverage.

Married Without Children

Married couples often share expenses, such as mortgage or rent payments, utilities, and credit card debt. If one spouse was to die prematurely without life insurance coverage, the other might find it difficult to continue the same standard of living and may be solely responsible for the couple’s joint debts. Life insurance death benefit proceeds can remove those financial worries.

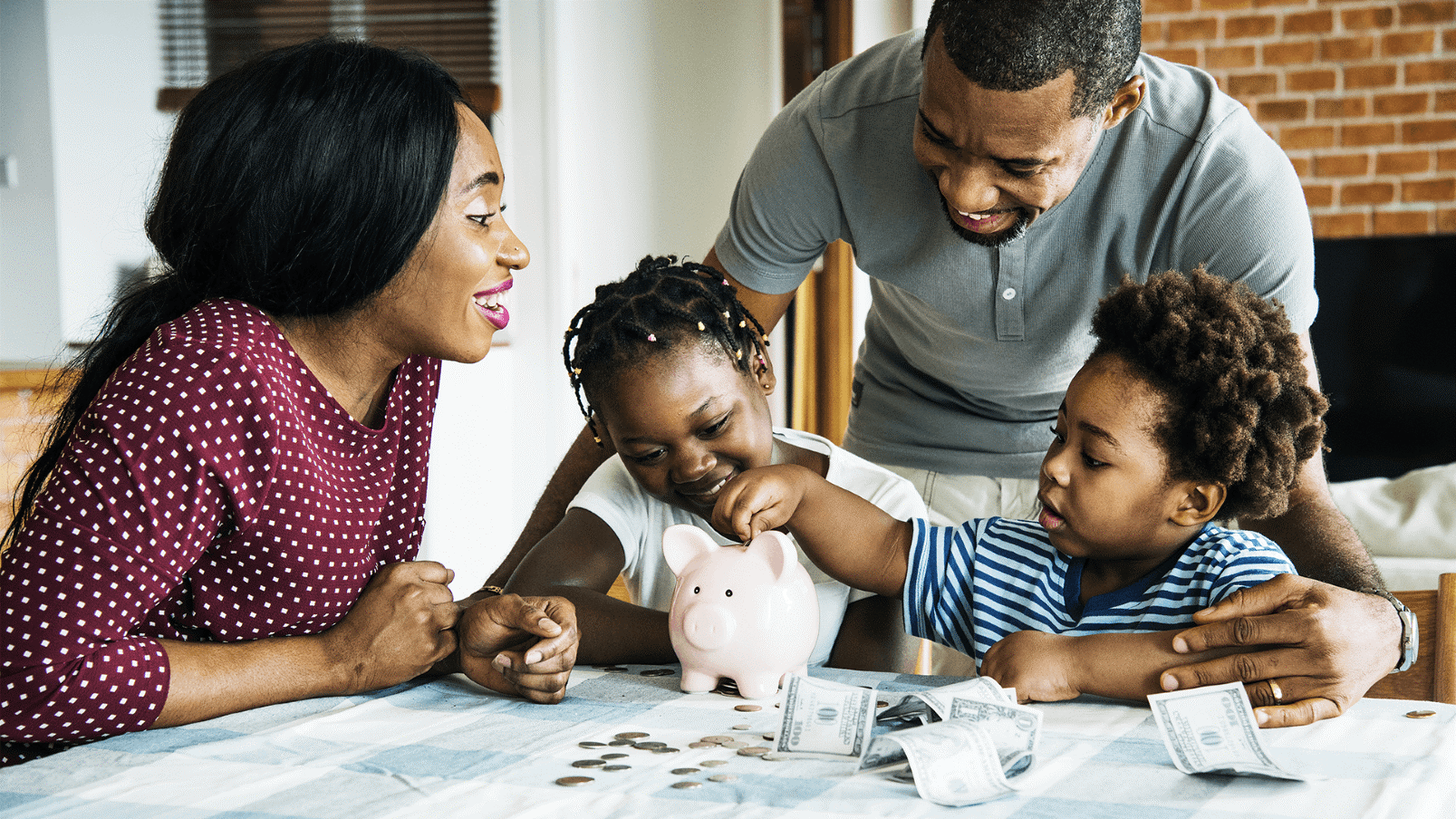

Married or Single with Children

When you are supporting minor children, life insurance is important to help ensure there would be sufficient assets available to continue raising your children until they reach the age of majority in your state. Parents often want to be able to pay for their children’s college educations; life insurance is another way to help provide

funds for college expenses

if you were to die prematurely.

Both working parents and stay-at-home parents may need life insurance coverage. In the case of a stay-at-home parent who dies prematurely, life insurance can provide funds to help pay for some of the many tasks that parent handled, helping limit disruption for childrens' routines.

Business Owners

Business owners can also use life insurance to protect the business and their loved ones from the consequences of a premature death. Using life insurance to fund a buy-sell agreement can provide the funds your business partners need to buy out your share of the company. Key person life insurance is another way to provide the business with the funds it would need to hire your replacement or otherwise continue the business without interruption.

Empty Nesters

While the amount of life insurance needed can change over time, parents of children who have grown and flown the nest may still need life insurance to pay off the mortgage or other debts, and to continue funding their spouse’s day-to-day life.

Retirees

Finally, seniors enjoying their retirement years often rely on life insurance policies to pay final expenses. Life insurance can also be used to create a powerful

financial legacy

for future generations or for charitable beneficiaries. And, seniors concerned about state and/or federal estate tax obligations can use life insurance to provide liquid assets that can be used to pay those taxes, easing the strain and burden on the next generation.

Symmetry Financial Group Can Help You Determine How Much Coverage You Need

The decision to purchase life insurance should be based on your specific financial situation, needs, and goals. Your Symmetry Financial Group Independent Insurance Agent can help you identify your coverage needs and will work closely with you to find affordable life insurance policies that will meet those needs.

To learn more about how life insurance can help protect your loved ones’ financial future,

contact us

today.