As we go through daily life, many of us don’t think about getting

life insurance

to prepare for the future or planning for retirement. While it’s often easy to delay these tasks, it is important to have a plan in place if you were no longer around.

Planning for your future is now easier than ever with customized insurance solutions fit for your specific needs. We’re taking a look at how to plan for different life stages with life insurance.

Choosing a life insurance policy

No matter your age, there is a life insurance policy that fits your budget, lifestyle and financial goals. When you work with a licensed insurance agent, you can find the policy or retirement plan that best fits your needs without the hassle of shopping around for the best price.

Term life insurance in your early career

If you are in your 20s or 30s, have young children, have student loans, or own a small business, a customized

term life insurance

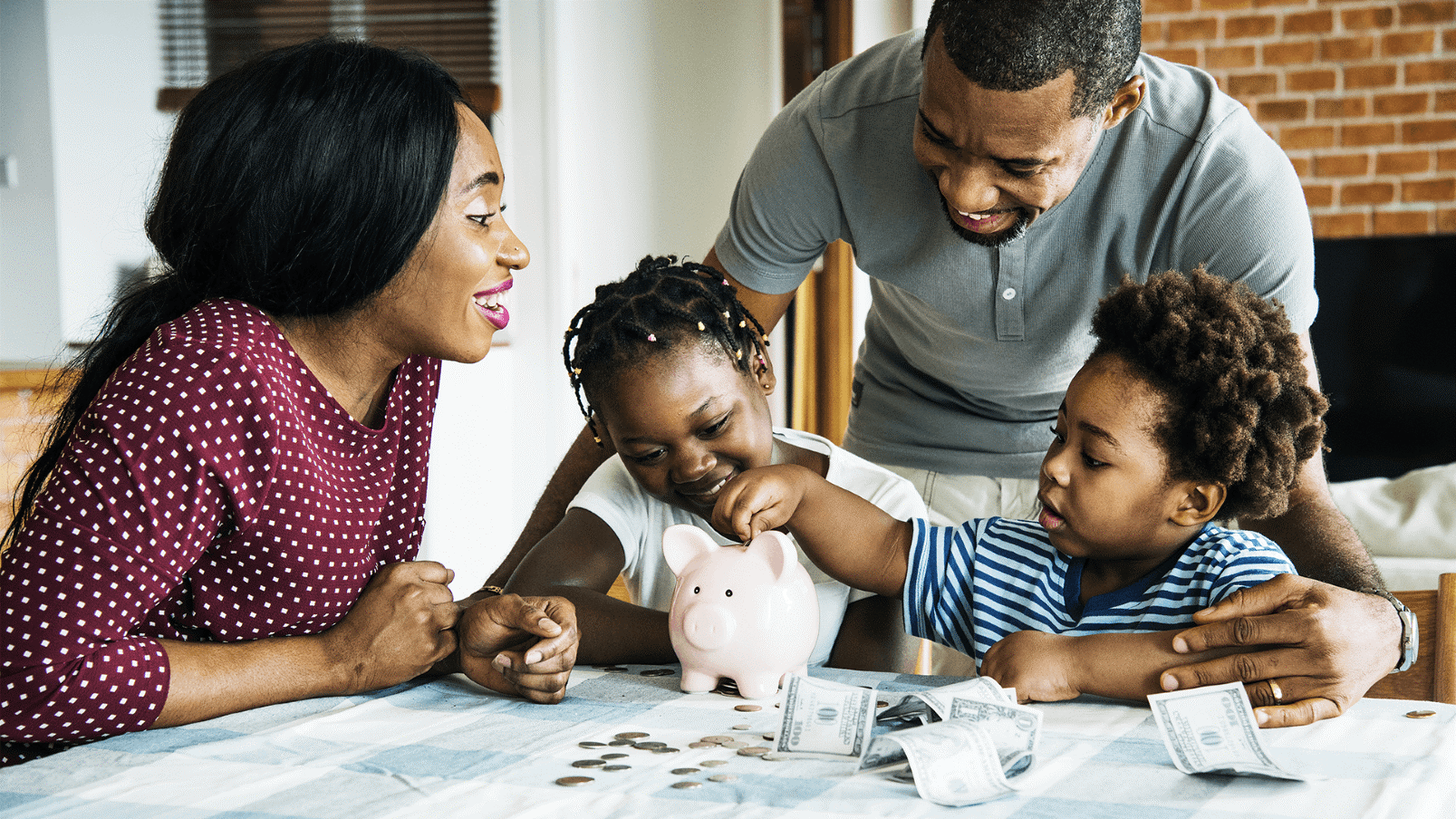

policy is an affordable insurance option. Having term life insurance while you’re young ensures that your loved ones aren’t left with any debts if you were to die – if you carry debts from student loans or a mortgage, the payout from a term life policy can cover these expenses if you pass away.

Life insurance can also make sure there is enough money for your children’s education or a loved one’s long-term care if needed. A term life insurance policy usually covers a range anywhere from 10-30 years, and you can choose the amount of coverage you need to support your loved ones if you die while the policy is in force.

Universal life insurance for lifelong coverage

Rather than lasting a set number of years, a

universal life insurance

policy would last a lifetime. With a universal life policy, you have the option to make periodic adjustments if your needs change over the years. Universal life insurance policies also offer a built-in cash value, so you can set money aside on a tax-deferred basis, right inside your policy. If you know that you will have financial obligations or you’ll likely have dependents for your entire lifetime, a universal life policy would be an affordable way to gain peace of mind and financial protection for your beneficiaries after you die.

Choosing a beneficiary

When you find the right type of life insurance for your needs, you will

designate a beneficiary

who will receive the death benefit of your policy if you pass away during the coverage period.

As long as you pay your premiums on time, your policy remains in force and you can have peace of mind knowing your loved ones are financially protected. Your beneficiary can use the death benefit to cover your remaining mortgage amount, cover your final expenses, fund a child’s education, pay off debts, or anything else that they choose. It’s important to choose someone you trust to ensure your final wishes are met.

Extra protection with riders

You can customize your life insurance policy with add-ons called

riders

, which can provide extra financial protection in the event of the unexpected while you’re alive. Living benefit riders are policy add-ons that can provide a payout if you were to face a critical illness diagnosis or a short or long-term disability.

Late career + Planning for retirement

Later in life, you might have invested in additional

retirement savings

accounts such as annuities or IUL’s during your working years. When you get close to entering retirement, you’ll want to check in on these accounts.

You might want to take another look at your will or estate plan, and ensure that all of these documents are stored in a safe place. Having these items in one place ensures that your loved ones will be able to find all this information, making it easy to ensure that everything is taken care of in a way that you designate.

Entering retirement

Once you finally reach your golden years and you're enjoying retirement, it’s important to make sure all your financial, health information, wills and life insurance beneficiary designations are up to date.

Check to make sure your chosen beneficiary is still aware that they oversee your plan, and you’ll be able to rest easy knowing that your plans are organized and secured for the future.

Contact your Symmetry Financial Group agent to get coverage today

Your Symmetry Financial Group agent can help you find the most affordable life insurance policy, annuity, or retirement plan that best fits your unique needs and goals.

If you’re interested in protecting your legacy with life insurance, connect with a Symmetry agent by

requesting a quote

today.