Did you know that student loan, auto loan and credit card debts have all increased in the past year? Though we are currently enjoying a relatively strong economy, lenders are allowing consumers to borrow more money than they can afford, which is leading to missed payments and debt.

We’re taking a closer look at the biggest causes of American debt, and how much these loans (and accompanying interest rates) are affecting your bottom line. Read on to find out how we can help you get rid of all of your debts in nine years or less!

Total Household Debt

In a

2019 report

, the Federal Reserve of New York found that total household debt increased to $13.86 trillion in the second quarter of 2019. This includes mortgages, auto loans, student loans and credit card debts.

As living expenses continue to rise, consumer debt will likely follow suit. Being informed about the different types of debt, and which ones you should prioritize, can help you break the cycle and get on track to becoming debt free.

Mortgage Debt

Mortgage loans still make up a significant chunk of consumer debt, yet people often credit a mortgage loan as one of the less “risky” debts because it’s tied to an asset that historically appreciates.

American households currently have $474 billion in newly originated mortgage debt, according to the

New York Fed

eral Reserve

. Although this type of debt has a lower delinquency rate on payments, mortgage debt is still one of the leading causes of debt on our list.

Auto Loans

The majority of non-revolving debt in America can be attributed to auto and student loans. According to the

New York Fed

, auto loans totaled $1.161 trillion. Due to low interest rates, auto loans are becoming more common, but people are paying off these loans more effectively than they are paying off their student debts and credit card balances.

Student Loans

Student loans are causing many recent grads to go into debilitating debt. These loans usually run from 10-25 years, and unlike auto loans, there is no asset for the bank to use as collateral. Student loan debt is a huge issue for recent grads: The

New York Fed

report found that 69% of graduates in 2018 took out loans and finished their degree with debts reaching $29,800. Even more, 14% of those graduates’ parents took out another $35,600 in loans, on average. And if you pursue a law degree, the average

amount of debt

goes up to $145,550.

There is currently

$1.5 trillion

in student debt, which is up $29 billion from the fourth quarter of 2018. And currently, more than 44 million students have student loan debt.

Credit Card Debt

The average household with

credit card debt

in America carries about $6,803 in revolving balances, with the total burden of debt in America reaching $434.3 billion. Since credit card debt accounts for 25% of all debt, this type of debt continues to be one of the heavier financial burdens that people struggle with.

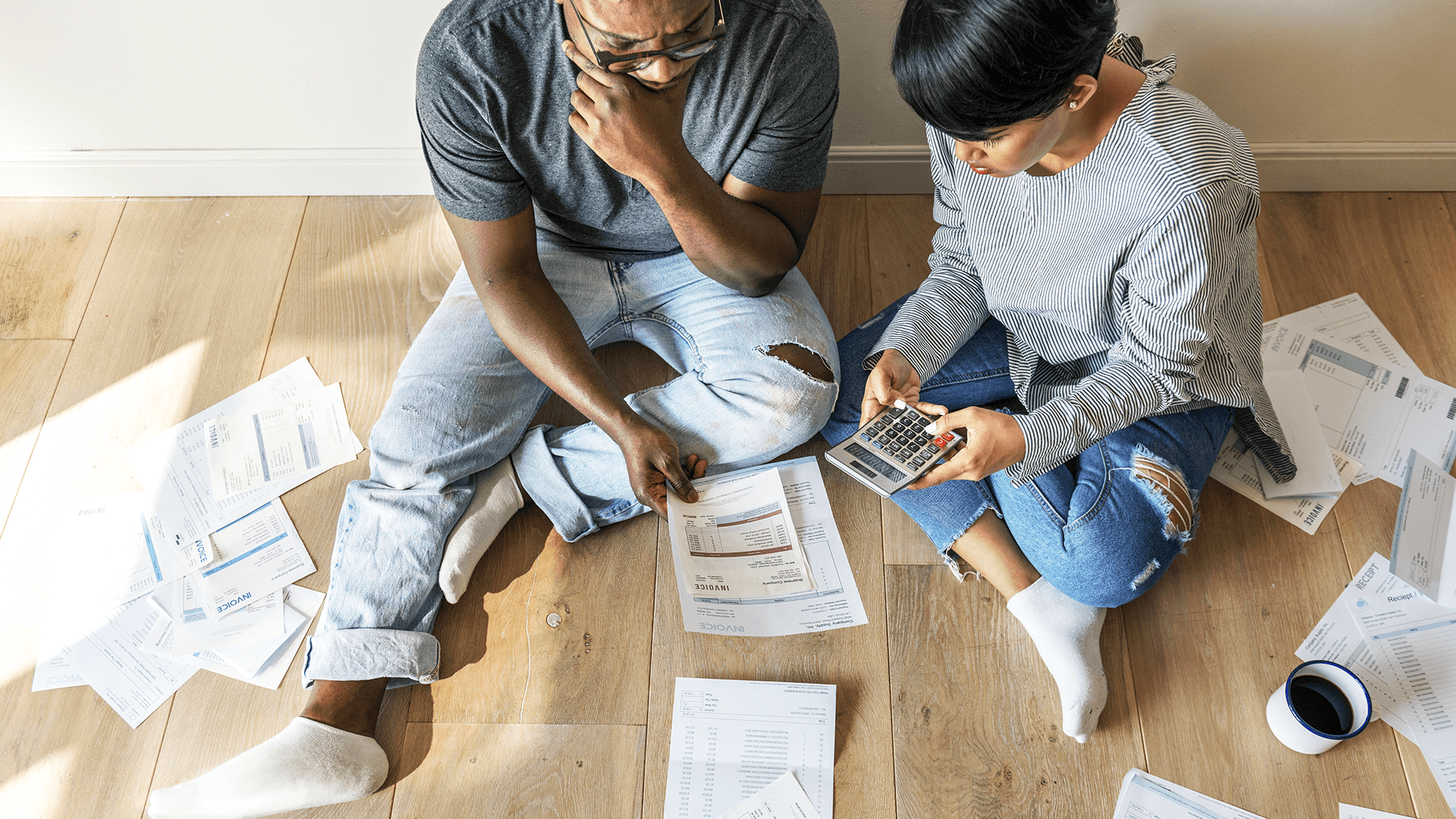

The Mental + Physical Burden of Debt

The

burden of debt

on mental and physical health is immense: 10-16 million people in the U.S. have reduced physical health due to high debts. Even more, those who struggle to pay off their debts are more than twice as likely to experience mental health struggles, including depression and anxiety.

Live a Debt Free Life in Nine Years or Less

What if there was a way to become debt free nine years from now, without spending any additional money? And what if, with this plan, you had the potential to save up to a million dollars or more for your retirement? With

Debt Free Life

by Symmetry Financial Group, you can!

Symmetry’s

Debt Free Life program

uses a time-tested investment and savings strategy that utilizes the cash value of a life insurance policy to fund purchases, rather than borrowing money from a lender. With this, you can use the tax-free money growing in your life insurance policy to pay down existing debt.

Want to learn more? Get in touch -

request more information

today!